Industrial Heat Pumps: Market Outlook and Role in Decarbonizing Industry

- Melchior Krijgsman

- Mar 28

- 5 min read

Updated: Apr 15

Introduction

Decarbonizing industrial processes is a critical challenge on the path to net-zero emissions. The industrial sector accounts for roughly one-third of global CO₂ emissions, and about two-thirds of those emissions come from the generation of heat for processes (see the article here: mckinsey.com). In other words, industrial heat alone contributes over 20% of total global CO₂ emissions. Industrial heat pumps (IHPs) have emerged as a key technology to tackle this challenge by electrifying process heat. IHPs use high-efficiency electrical compression cycles to produce hot water or steam, often 3–5 times more efficient than traditional gas or oil boilers at low to medium temperatures (check the article here: mckinsey.com). By leveraging renewable electricity, they can supply the same heat with a fraction of the energy input and carbon footprint. The International Energy Agency (IEA) estimates that deploying heat pumps (across buildings and industry) could cut at least 500 million tonnes of CO₂ emissions globally by 2030 – equivalent to the annual emissions of all cars in Europe (see the article here: iea.org). Recent surges in fuel costs and stronger climate policies have further spurred interest in industrial heat pumps as a route to improve energy efficiency, reduce emissions, and provide resilience against volatile fossil fuel markets.

Industrial Heat Pump Market Overview (Global vs. Europe)

Global Market:

The global industrial heat pump market is growing rapidly from a relatively small base. In 2023, the market was valued around $9.5 billion, and it is projected to reach $19.3 billion by 2033, roughly doubling in a decade (7.4% CAGR), for more info check here: alliedmarketresearch.com. Some analyses are even more confident – for example, McKinsey forecasts >15% annual growth in industrial heat pump sales through 2030 under the push for heat electrification (as mentioned here and in the graph below by: mckinsey.com).

This growth trajectory reflects IHPs moving from niche to mainstream as industries seek to replace coal- or gas-fired boilers. By one estimate, industrial heat pumps could supply over 10% of global industrial and district heating demand (for processes below 200 °C) by 2030 (as mckinsey.com highlights). Investments are following suit: global investment in industrial heat pumps is expected to reach $12 billion per year by 2030 (a fourfold increase from 2023) under current policies, and up to $21 billion with more aggressive climate commitments (for more data and graphs, check the article here: mckinsey.com). Industrial heat pump adoption is accelerating in Asia, North America, and emerging markets, driven by net-zero goals, carbon pricing, and efficiency gains. Electrified heat often lowers operating costs, especially when replacing costly fuels or using waste heat. Each unit of heat from a pump can cut CO₂ emissions by 60–80% or more, especially as power grids become greener. (for more info consult this study: ehpa.org).

European Market: Europe currently leads in policy support and early deployment of industrial heat pumps, although its market size is still modest. The European industrial heat pump market was valued at only ~$464 million in 2023, reflecting the nascent adoption in heavy industry so far. Conservative forecasts see steady growth (~5–6% annually to 2032), check the data here: gminsights.com, and in the graph below:

But in practice the momentum is accelerating beyond that as EU climate targets tighten. Europe is implementing robust incentives: nearly all European countries now offer financial subsidies or tax breaks for companies investing in industrial-scale heat pumps

(as ehpa.org has shown in his report). For instance, programs under the EU Green Deal, national recovery plans, and carbon pricing (EU ETS) all favor electrification of heat. High natural gas prices in recent years have also improved the operating cost advantage of heat pumps in Europe (as you can check here: wbcsd.org).

As a result, the EU is expected to be a major growth region for IHPs this decade. McKinsey analysis projects that by 2030 in the EU-27 (plus UK), heat pumps will provide about 15% of all district heating and 20% of industrial process heat for temperatures up to 200 °C (see the article mckinsey.com and Fig. 1). Industrial heat pump market share in Europe jumped over 10 points in 2023, led by countries like Germany, France, the Nordics, Poland, and the UK. With 60% of industrial energy used for heat, full decarbonization by 2050 is essential. The EU is preparing an “Industrial Decarbonisation Accelerator Act” to support this. Backed by strong policy, the market is growing fast, and many companies are now turning to heat pumps—often seeking expert, independent advice from firms like Entropic (check it out here: https://www.iigcc.org/insights/new-eu-clean-industrial-deal-chimes-with-investor-recommendations).

Key Industrial Heat Pump Manufacturers

Several equipment manufacturers have developed industrial-grade heat pump systems, with several reaching high technological readiness for deployment. Table 1 below lists five leading IHP manufacturers (from a recent survey of available high-temperature heat pump offerings, made by Entropic. If you want more send us an email! melchiorkrijgsman@entropic.energy) and highlights their capabilities:

Manufacturer | Headquarters | Max Output Temp | Notable Technology |

Johnson Controls | Ireland (USA) | up to ~120 °C | High-performance ammonia piston heat pumps (incl. Sabroe line) |

GEA Refrigeration | Germany | up to ~120 °C | Ammonia-based semi-hermetic piston compressors for process heat |

Mitsubishi Heavy Industries | Japan | ~130 °C | Two-stage centrifugal heat pump systems for steam generation |

Mayekawa | Japan | up to ~145 °C | Industrial reciprocating & screw heat pumps (e.g. “EcoSirocco” using natural refrigerants) |

Siemens Energy | Germany | >160 °C | High-temperature turbo-compressor heat pumps for district and industrial use |

Table 1 highlights Entropic’s analysis which highlights top industrial heat pump manufacturers focused on high-temperature solutions using natural refrigerants and advanced compressors.

Use Cases and Decarbonization Applications

Industrial heat pumps are particularly well-suited for low- and medium-temperature process heat applications, which constitute a significant share of industry’s energy needs. An estimated 37% of all industrial process heat in Europe is below 200 °C, a range that modern heat pumps can typically service. In practice, today’s high-temperature heat pumps can reach outlet temperatures around 100–150 °C with off-the-shelf systems, and some advanced units now achieve up to ~180–200 °C (see the article: ehpa.org). This makes them applicable across a broad spectrum of industries:

Food & Beverage: Heat pumps supply hot water/steam for processes like pasteurization and cleaning by recovering waste heat, reducing gas use.

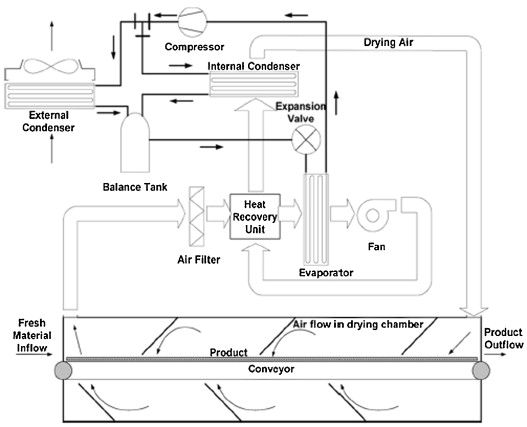

Pulp & Paper: Used to generate ~120 °C steam from waste/ambient heat, replacing fossil-fueled boilers in energy-intensive drying operations.

Chemicals & Pharma: Ideal for processes under 150 °C, capturing and reusing heat from reactions or condensers for drying or heating (for the article see here: ehpa.org).

Textiles & Wood: Provide 60–120 °C heat for dyeing, finishing, and drying, improving efficiency and precision while also offering cooling or dehumidification (for the article check here: ehpa.org).

A common thread in these use cases is energy efficiency and circular use of heat. Heat pumps not only replace fossil fuel burners; they often integrate with existing systems to capture waste heat that would otherwise be vented. By upgrading low-grade heat to useful temperatures, they can cut total energy consumption by 40–60% in each process, and some players of the landscape are already doing it, like in the example of cimcorefrigeration.com. For instance, instead of rejecting 40 °C waste heat from a process to a cooling tower, an industrial heat pump can take that heat and boost it to 100+ °C to feed another process, substantially reducing the need to burn fuel. This synergy is why heat pumps are described as a “future-proof technology for process heat supply”, capable of reducing CO₂ emissions by over 80% in optimized scenarios while improving energy efficiency (for more data check here: ehpa.org). While industrial heat pumps (IHPs) have higher upfront costs than traditional boilers, they offer strong returns through energy savings, government incentives, and carbon credits.

Conclusion

Industrial heat pumps (IHPs) are becoming key to decarbonizing industry by enabling efficient, electric process heat and emissions cuts. Their market is growing rapidly, with expanding high-temp capabilities and use across many sectors. IHPs recycle waste heat and run on renewables, supporting net-zero goals and lowering costs. Success depends on choosing the right solution for each case, and Entropic offers expert, unbiased guidance to help firms select and integrate the best technologies. IHPs are a practical, cost-effective way to build cleaner, more efficient industrial operations.

Comments